I thank God, there are no free schools nor printing

In 1671, Governor William Berkeley of Virginia wrote: "I thank God, there are no free schools nor printing and I hope we shall not have, these hundred years, for learning has brought disobedience, and heresy, and sects into the world, and printing has divulged them, and libels against the best government. God keep us from both."

[Colonial Williamsburg, Early American Newspapering by James Breig]

|

| EDUCATION |

|

| WHITE HOUSE |

FROM 30,000 FEET -- BURGESS

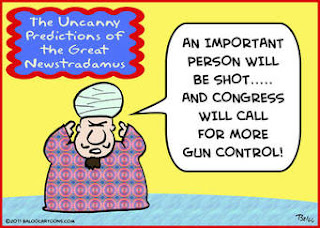

EVERETT and ELANA SCHOR: "The 'attention-deficit-disorder'

Congress": "Even in peak form, Congress struggles to focus on any one

issue for more than a few days. But its short attention span has taken on new

meaning in the era of Donald Trump. 'We kind of have attention deficit

disorder,' as Sen. John Kennedy (R-La.) put it.

"Every time it seems the president

has zeroed in on an issue, and appears determined to

see it through - guns and immigration are just the two latest examples - he

moves on to something else. And Congress, which isn't designed to respond

swiftly to national events and the wishes of the White House even in the least

distracted of circumstances, simply can't keep up. The constant whiplash of

priorities is getting on lawmakers' nerves. [POLITICO

Playbook, March 12, 2018]

A GUY HANDED OUT APPLES as you walked in the

door. The bartender served apple old-fashioneds. And CNN chief Jeff Zucker held

court on a couch with apple pillows. The network's fruit-themed space in

downtown Austin served to highlight its recent "Facts First" ad campaign that states how an apple is, well, an

apple.

- Media companies are known to tout new

innovations and roll out products at South by Southwest, and this year was no

exception. But they also used this year's festival as a way to reinforce their

own brands in an increasingly crowded marketplace. The New York Times was all about

its "Truth" campaign when setting up shop at Irene's bar.

Attendees who came for drinks and journalist talks on technology, music and

politics could leave with buttons reading "Truth. It's more important now

than ever." [Morning Media, March 12, 2018]

Going down, down, down, down: Speaking

of multinationals, it's closing in on a decade since the financial crisis - and

it's been a pretty good 10 years for their tax bills, The Financial Times

reports. The paper found "that a decade of government efforts to cut

deficits and reform taxes has left the corporate world largely unscathed."

In all, those corporations' effective tax rates have fallen 9

percent in the last 10 years. Reduced statutory corporate rates around the

world account for only about half of the drop, the FT found, which suggests

that companies are also finding plenty of ways to evade global efforts to crack

down on tax avoidance. [POLITICO's Morning Tax,

March 12, 2018]

SUPPOSED TO BE DONE WITH THOSE? One of the GOP's major selling points for its new tax bill

was that it would stem the

tide of corporate

inversions - that recent rush of U.S. companies seeking to set up their

official address offshore for tax purposes. And yet Dana, an auto parts company

in Ohio, could soon by headquartered in the United Kingdom if it's successful

in taking over a British competitor, GKN PLC, The Wall Street Journal reported

on Friday. The company's chief financial officer told the WSJ that the deal,

which is far from a sure thing, would still have tax benefits for the company,

even though the U.S. corporate rate of 21 percent is now well within shouting

distance of the U.K.'s 19 percent. But Robert Willens, a corporate tax expert,

said those benefits were hard for him to see - especially given the current

limits on earnings stripping, which gave companies tax benefits for loaning

money between a foreign parent and a U.S. subsidiary. "The U.K. tax rates

are very close to U.S. tax rates," Willens told the WSJ. "Now, with

the corporate benefits of an inversion being difficult to identify, you're

creating a tax for your shareholders which seems unnecessary." [POLITICO's

Morning Tax, March 12, 2018]

|

| PUTIN |

What did Putin say in his interview with Kiselyov? He said Ukraine is never getting Crimea back, he blamed the

August 2000 Kursk submarine disaster (one of the first scandals of his

presidency) on the neglected state of Russia’s post-Soviet military, and he

recalled how his helicopter came under fire in Chechnya in 2000. Kiselyov also

spoke to Andrey Kondrashov, Putin’s campaign manager; Nikolai Patrushev, the

secretary of Russia’s Security Council; Defense Ministry Sergey Shoigu; and

Sergey Roldugin, the cellist named in the “Panama Papers” as the man who

supposedly links Putin to billions of dollars in illicit wealth. [The Real Russia. Today. March 12, 2019]

|

JEFFERSON BEAUREGARD SESSIONS III

Attorney General

|

One reason Trump will never forgive Attorney General

Jeff Sessions for recusing himself is because he will never respect that the AG

says his ultimate loyalty lies with institutions and norms, not Trump. The

president wants everyone who works "for him" — including members of

what he calls the "Trump Justice Department" — to be loyal to him

personally, above all else. [Axios Sneak Peek, March 11, 2018]

|

| READ |

|

| WOMEN’S RIGHTS = HUMAN RIGHTS |

|

| WOMEN |

North

Carolina: North Carolina Republicans just can’t quit

trying to remove Democratic majorities from state and county elections boards

so that Democrats can't

reverse past voter suppression measures Republicans passed when they

held majorities. Democratic Gov. Roy Cooper's lawyers have now indicated

he plans

to once again sue over the

GOP's latest attempt, which is their third since he won the 2016 election.

The GOP's new measure is supposed to take effect on March 16, but litigation

over their second attempt is still

unresolved.

The

Republican legislature's latest law creates

a nine-member state board with four Republicans and four Democrats,

who then choose a ninth member who isn't affiliated with either major party.

But the law says nothing about what happens if those eight members can't agree

on a tiebreaker, effectively giving the GOP veto power over board

decisions. And Republicans had previously changed the law so that if the

local board fails to set a plan for early voting, counties revert

to just one early voting site each; this could result

in long early voting lines that dampen turnout in heavily

populated Democratic-leaning counties.

Meanwhile,

Cooper's lawsuit against the second incarnation of the GOP's elections board

power grab is still in

progress. Back in January, the state Supreme Court delivered what seemed to

be a major victory for Cooper when it ruled

the law violated the separation of powers in the state constitution by

requiring the governor to pick an equal number of members from both parties and

no tiebreaking member.

However,

the high court had directed the lower-level court that heard the case to

reconsider their initial ruling upholding the law, and on Monday the lower

court only threw

out part of the law. They struck down the portion that would have blocked

Cooper from nominating Democrats for a majority of the seats on the board, but

they left in place a provision that merged the state's ethics and elections

board into one body and another provision that makes Republicans

chairs of these boards in even-numbered years, when federal and state

elections happen. Most worrisome is that the lower court upheld the

aforementioned provision that forces counties to revert

to one just early voting site if local boards deadlock, which is

exactly what Republicans intend to happen.

Consequently,

Cooper appealed

to the state Supreme Court to throw out the entirety of the second

iteration of this law. Given that Democrats hold a majority on that court and

the justices already acted to curb the GOP's power grab, Cooper may stand a

good chance of success on appeal.

But even

if Cooper succeeds, Republicans' third and latest law will still soon go into

effect and force him to file yet another lawsuit. But this latest law has a

"poison pill" attached intended to trap Democrats into

choosing between public education and fair election administration: Republicans

included completely unrelated education provisions that Democrats had favored

and declined to include a severability clause, intending to force the

whole law to get thrown out if any part of it gets struck down. [Daily Kos. Voting Rights Roundup, March 9, 2018]

New Hampshire: On a near party-line vote, Republican state House

members have

passed a bill that would tighten voter residency requirements by

altering the legal definition of residency for the purposes of voting. This

narrower restriction is

designed to suppress the votes of out-of-state college students

because they lean Democratic, and it would all but amount to a poll tax by

requiring them to take actions like registering their car in-state—which costs

money—simply to register to vote. Of course, Republicans have offered no

evidence that ineligible out-of-state residents are voting illegally in the

Granite State.

This bill

now goes to the state Senate, where Republicans approved

a similar bill back in 2017. Republican Gov. Chris Sununu had

previously claimed

he opposed that measure, but he pointedly did not promise he would have vetoed it if

that bill had reached his desk. Sununu signed

a similar measure that imposes additional burdens on student voters,

so his supposed opposition to this latest bill must be viewed with skepticism.

But even if the Senate and governor both agree to this new restriction,

opponents should have an strong case before the state Supreme Court, which

unanimously struck down a similar GOP-backed law in 2015. [Daily Kos. Voting Rights

Roundup, March 9, 2018]

|

| SCREEN |

|

| U.S. AGRICULTURE |

THUNE: A DEAL TO FIX TAX INCENTIVES FOR CO-OPS: Many

weeks after the problem was discovered, lawmakers have reached a final

agreement to fix a section of the new tax law that created huge financial incentives

for farmers to sell their products to agriculture co-ops. The deal was

circulating among lawmakers and industry stakeholders on Wednesday, according

to Sen. John Thune (R-S.D.). The senator, who holds the third-highest ranking

Republican leadership post, told reporters that the legislative language is

done and just needs sign off from key negotiators before being shared publicly...

"I think everybody is in pretty good shape," Thune

said. "I'm sure there is not 100 percent unanimous consent, but the

organizations we are working with, both on the private grain elevator side and

co-op side, have been involved in all of this. So I think we are about

there."

A ride in the next spending bill: The

tentative agreement is expected to be included in the fiscal 2018 omnibus

appropriations package that Congress must pass before March 23 to keep the

government open. "If this drags out any longer, it will create a lot of

problems," Thune said.

The predicament: The section in need of fixing is known

as Section 199A, a special deduction for agricultural co-ops that Thune and

Sen. John Hoeven (R-N.D.) hastily added to the tax overhaul in the final rounds

of negotiations in order to preserve certain benefits in place under the

previous tax code.

The language allows

farmers to deduct up to 20 percent of their gross sales to cooperatives - a

more lucrative tax break than if they were to sell to a privately held grain

elevator or other type of company, which would allow a smaller deduction of 20

percent of a farmer's income.

Thune, Hoeven and House

GOP leadership have been working with the National Council of Farmer

Cooperatives and National Grain and Feed Association on a solution to avoid

unbalance in the marketplace. The parties were looking at reverting back to the

old deduction for co-ops, known as Section 199, which allowed a roughly 9

percent tax break. Co-ops often passed that on to their farmer members.

. [POLITICO's Morning Agriculture ,

March 8, 2018]

CRUNCH TIME: The big 2018 federal spending

package might hit the congressional floor this week - and if it does, there

will be a lot of people in the farming community interested in its contents.

That's because GOP lawmakers have been working furiously to try

to roll back the so-called "grain glitch," the provision in last

year's tax package that gives a sizable tax cut to farmers who sell grain to

cooperatives. Top Republicans have been saying that they were closing in on a

fix, after hearing an earful from agriculture interests in recent weeks. But

how willing will Democrats be to allow that sort of correction in the omnibus

spending bill, given that they were largely shut out of the writing of the tax

bill? That's another question entirely.

The lobbying continues: To be clear, there are

definitely some Democrats who want to see this glitch fixed as fast as possible

- including Gov. John Bel Edwards of Louisiana. Edwards wrote to congressional

leaders last week, urging their "immediate attention." Without a fix,

"many local and family-owned businesses will be at a distinct competitive

disadvantage in the marketplace and will result in lost business and lower

wages, the exact opposite of what the Tax Cuts and Jobs Act was intended to

produce," Edwards wrote, along with Mike Strain, the state's Republican

agriculture commissioner.

The New York Times, in a broader piece about the fixes the tax

bill might eventually need, noted that independent grain companies from Minnesota, Oklahoma and

South Dakota headed to Washington late last month, "warning that

businesses like theirs could collapse or be sold." [POLITICO's Morning Tax, March 12, 2018]

SNAP PROPOSAL ENDANGERS BIPARTISAN FARM BILL: The

farm bill was teed up and ready to go, but there is just one hitch: what to do

about the Supplemental Nutrition Assistance Program.

A meeting last week between House Agriculture Chairman Mike

Conaway and a group of Democrats on the panel over proposed SNAP changes ended

in an "impasse," according to ranking member Collin Peterson.

Peterson told the American Ag Network that if the farm bill is

introduced in its current form, Democrats are likely to oppose it during a

markup tentatively scheduled for March 20, threatening a pledge for a

bipartisan process…

Requiring work: Conaway and Peterson

are continuing to negotiate over the SNAP proposal, which would expand the

number of adults - including able-bodied adults without dependents, known in

jargon as ABAWDs - who are subject to work requirements. In part, this would be

done by raising the work requirement to age 65, according to committee

spokeswoman Rachel Millard. ABAWDs aged 18-49 can now receive food stamps for

three months as long as they work or are in an employment and training program.

Under Conaway's proposal, they would have to meet work requirements until age

65.

Money saved as a result of those changes would be invested in

SNAP education and training programs to provide recipients with work

opportunities. States would maintain their authority to decide who can be

exempted from existing work requirements - those may include retirees, people

with temporary injuries or those who live in areas where fewer employment

options are available.

Still a path for bipartisanship? In

a statement, Conaway told POLITICO that he and Peterson have continually worked

together to develop the farm bill, and is proud of their effort. "I have

always intended and continue to hope that this farm bill will be a bipartisan

bill. There is no reason that it should not be and every reason it should. Our

farmers and ranchers are hurting," he said.

Conaway added: "In regard to SNAP, I successfully led

efforts to prevent cuts to the farm bill, including to SNAP, last year and my

position has not changed. That is a matter of public record. I have made it

clear that policy, not budget cuts, will govern the writing of this farm bill,

including SNAP.

"In fact, not one person would be forced off SNAP due to

the work or training requirements we have been discussing. Not one,"

Conaway said. "Our approach is not even remotely like the approach taken

in 2013 that caused the farm bill to fail."

Conaway was referring to the fallout from an amendment offered

by then-Rep. Steve Southerland (R-Fla.), which would have allowed states to

impose stricter work requirements on SNAP recipients without also including

funding for education or training opportunities. It would have also allowed

states to keep 50 percent of the savings from lower SNAP participation.

Political football: Conaway also said some

members of the Democratic leadership may not want Congress to pass a farm bill

to "score points" ahead of the midterm elections in November. Rep.

Jim McGovern (D-Mass.), ranking member of the nutrition subcommittee, recently

told anti-hunger advocates that Democrats could pass a better farm bill after

November. He encouraged those groups to try to defeat the measure if its

passage would worsen hunger in America. McGovern told POLITICO on Friday that

he still hadn't seen the nutrition title of the farm bill. [POLITICO's Morning Agriculture, March 12, 2018]

NOTE: The news sources here vary. Not all sources have the same credibility, but in an effort to share some different perspectives, they are included here. This compendium itself cannot claim to be unbiased. Please take into consideration where these different perspectives originate in assessing their value. Thank you

NOTE: I have no official connection to any organization from which information is shared.. Occasionally, I post informational material and/or an opportunity to donate or join as a "community service" announcement. These again are shared for their varying perspectives.

Any books listed are random or topic-related to something else in the post. Think of these as a "library bookshelf" to browse. They are shared for informational or entertainment value only, not as being recommended

Comments

Post a Comment