The misery that is now upon us

is but the passing of greed... Charlie Chaplin, The Great Dictator

The tax bill shouts, 'Greed!' OPINION | JEFFREY D. SACHS, THE BOSTON GLOBE, NOV. 28,2017

GOP Tax Plan Full Of Loopholes For Wealthy

The House tax plan conveniently full of “drafting glitches” that benefit the rich. Vanity Fair:“Both the House and the Senate’s plans are, by design, extremely good for both corporate America and the ultra-rich, given that they slash the corporate tax rate to 20 percent; repeal the alternative minimum tax; increase the inheritance tax exemption before completely eliminating it; provide a tax break of more than $30,000 per child sent to private school; preserve a deduction for golf course owners; and in the case of the Senate plan, create a tax cut for private jet owners. And those are just the plan’s overt aims—according to Bloomberg, House lawmakers have also included, whether intentionally or not, a number of loopholes that specifically benefit Wall Street investors and wealthy heirs and heiresses. Tax experts have reportedly found an ‘unusual’ number of ‘drafting glitches’ and loopholes that, whether they were ‘intentional or accidental,’ would save the country’s richest a whole lot of money… While Levine admitted that the measure is ‘very welcome for my clients,’ he said that it’s a total scam on the part of lawmakers. “’As a matter of tax policy it’s completely indefensible,’ he told Bloomberg. ‘It permits income that is obviously income, in a constitutional sense, to go entirely untaxed.’

IT AIN'T JUST THE TAXES It's not really a secret that low (or even nonexistent) tax rates make places like Bermuda and the Cayman Islands a big draw for rich people looking to stash their money. But as CNN Money reports, low tax rates doesn't really explain whether a country's residents will choose to keep their accounts local. For instance: The United Arab Emirates and Saudi Arabia, both with personal income tax rates of zero, are two of the top three countries when it came to wealth banked abroad back in 2007. Instead of taxation, researchers found countries with high rates of money held offshore typically are rich in natural resources, or have a history of political instability and corrupt, autocratic governments. For example, Russia's offshore wealth rate is 13.2 percent, well above average.

| GOP Rep. Darrell Issa (Calif.), opposes the plan, and why it could still face a big problem in the House with other moderate Republicans: “For taxpayers in our district, being able to deduct their state and local income taxes from their federal return is the first line of defense against the tax increase factory the Democrats have built in Sacramento. … For Americans with leaders in their state Capitol less greedy than our own, eliminating the deduction makes little difference. But for us, eliminating the ability of Californians to deduct their hefty state and local taxes significantly compounds the substantial burdens already imposed on the taxpayers by our state.” [Washington Post, Nov. 21, 2017] |

“Republicans in Congress must believe voters are dolts. Nothing else can explain the tax bill that just passed the House with 227 Republican votes and no Democrats. No rational person would make the choices that are in this bill. As soon as they finish raiding the Treasury for big corporations and the wealthy, Republicans will push for more cuts in everything from education to Head Start. That isn’t just corrupt. It is criminal.”

Republicans are doing EVERYTHING in their power to strip millions of Americans of their health care and cut taxes for the wealthy.

WHAT WE CAN DO!

Now, just like with healthcare, if we make some noise, show up, and put relentless pressure on our members of Congress, we can win. Here’s how we do it:

Show up.

- Indivisible groups are staging 50 sit-ins at their Senators’ offices and there are dozens more events planned this week (find an event here!).

- Show up to your Senator’s in-district office as often as you can between now and the vote. Use our event organizing guide to plan your event and then register your event so others can find it here.

Make a call.

- We’ve set up a toll-free number to make it easier to call your Senators at 1-855-980-2350. That number will connect you to one of your Senators and, if you call back again, it’ll automatically connect you to your other Senator.

- If you have a Republican Senator, use our call scripts to inform your conversation. Republicans need to hear just how much you hate this bill.

- If you have a Democratic Senator, they need to hear from you too! Use our call scripts for Democrats to encourage them to stand strong and voice their concerns about this bill.

Call progressives in key red states.

- You should always only contact YOUR Members of Congress (MoC). We’ve set up our popular peer-to-peer calling tool so that after you’ve called your MoC, you can reach out to progressives in red states, let them know how important their voice is in this fight, and connect them directly to their Senators.

- Sign up here to make calls using our peer-to-peer tool. You can make calls as much as you want from 9am to 9pm (local time) each and every day to progressives in Alaska, Arizona, Tennessee, and West Virginia.

This bill is bad, bad, bad (if you need a reminder of how bad it is, read up on it here). But we can stop it if we all show up the same way we did for healthcare.

|

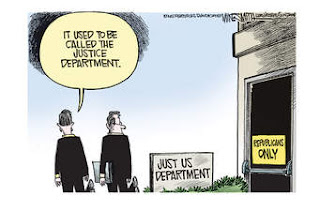

DOJ |

|

U.S. MILITARY |

|

UNITED KINGDOM |

NOTE: The news sources here vary. Not all sources have the same credibility, but in an effort to share some different perspectives, they are included here. This compendium itself cannot claim to be unbiased. Please take into consideration where these different perspectives originate in assessing their value. Thank you

NOTE: I have no official connection to any organization from which information is shared.. Occasionally, I post informational material and/or an opportunity to donate or join as a "community service" announcement. These again are shared for their varying perspectives.

Any books listed are random or topic-related to something else in the post. Think of these as a "library bookshelf" to browse. They are shared for informational or entertainment value only, not as being recommended

NOTE: I have no official connection to any organization from which information is shared.. Occasionally, I post informational material and/or an opportunity to donate or join as a "community service" announcement. These again are shared for their varying perspectives.

Any books listed are random or topic-related to something else in the post. Think of these as a "library bookshelf" to browse. They are shared for informational or entertainment value only, not as being recommended

Comments

Post a Comment